Business Tax Services

Vitae® Tax is a one-stop-shop for all your business tax service needs. Tax compliance is a key contributor to your peace-of-mind, which allows you to focus on business growth, value, and success. We will work with you to solidify the future of your business.

Business owners, entrepreneurs, and managers all have one thing in common: busy multitasking, juggling priorities, keeping track of your core business. You have very little time to structure, organize, and document every nuance of your business tax needs. As a team, we’ll turn time-consuming and monotonous tax record-keeping into a real opportunity for you to make informed and smart tax related decisions.

![]() From the onset, you’ll experience freedoms from burdensome, and time consuming record-keeping tasks. We can help you structure compliant business tax accounting, giving you more time to focus on your running and growing your business.

From the onset, you’ll experience freedoms from burdensome, and time consuming record-keeping tasks. We can help you structure compliant business tax accounting, giving you more time to focus on your running and growing your business.

![]() Then on day two, you’ll see that we do not manage from a cookie-cutter template of services. Understanding that no two businesses are alike, we will organize your relevant tax paperwork and help build financial structures to measure the results of your hard work and dedication while complying with your tax obligations.

Then on day two, you’ll see that we do not manage from a cookie-cutter template of services. Understanding that no two businesses are alike, we will organize your relevant tax paperwork and help build financial structures to measure the results of your hard work and dedication while complying with your tax obligations.

![]() Long term, you’ll discover convenience and security of having your personal account manager. This unique business setup allows for a dedicated resource working and supporting your tax needs all year round, including managing your tax deadlines and associated reporting.

Long term, you’ll discover convenience and security of having your personal account manager. This unique business setup allows for a dedicated resource working and supporting your tax needs all year round, including managing your tax deadlines and associated reporting.

We stand with you and your managers to give you our full attention and full abilities as professional tax accountants and tax preparers

We offer comprehensive business tax strategies and flexible financial tactics to help you achieve tax compliance, which helps contribute towards enhancing the value of your business.

You’ll gain tailored tax-oriented solutions and tax structure that fit your business goals and needs, setting you on the path for growth.

We ensure that your business receives all the attention it needs taking advantage of every available tax benefit, deduction, and credit.

We make sure your tax filings are in full compliance with State and Federal requirements.

Vitae® Tax – in business to take on work, not load you with more of it.

Ready to get to work?

Tax Advice and Consultation

There’s an underlying business axiom that the right tax advice at the right time can build business value. From the first day we meet, you’ll be introduced to a team working for you to do precisely that: build value for your business. Your team will include certified public accountants (CPA), enrolled agents (EA), account managers, bookkeepers, accountants, and registered tax professionals, all working for you with their expressed mission: to ensure your business is meeting your tax compliance requirements, thus allowing you the time to build value for your business.

Did you know entrepreneurs and self-employed contractors are required to adhere to the same tax reporting requirements as are small to medium-sized businesses (SMBs)?

Large or small, we support you and your organization with timely advice and consultation for tax accounting, preparation, and filing requirements. We help the self-employed and SMBs keep up with every change in tax law, some of which provide enormous benefits that are unique to their situation.

Our reputation is our commitment to quality.

We structured Vitae® Tax around teams of professionals who have decades of experience between them. Our in-house teams will work with you to diagnose your tax situation, design a tax plan to achieve your goals and help you make them a reality. We specialize in tax, but we know your needs as an entrepreneur, self-employed or SMB owner go beyond taxes. We also realize that finding the right service provider for other business needs can be a time-consuming task. To better serve you and your non-tax needs, we have built long lasting relationships with trusted partners whose backgrounds range from local independent professional providers to large national institutional companies.

Vitae Tax offers unique industry structures, which are proven to help your personal and business goals and tax needs

Our tax business advisors will consult with you and provide a path forward to attain your tax compliance goals. Your personalized plan will include tax accounting and consulting services provided by Vitae® Tax, as well as input from non-tax professionals essential to the growth of your business.

Our network of trusted service providers have expertise in tax law, labor law, business law and representation, human resources, commercial banking, business insurance, financial investment advice, real estate, and many other areas that will benefit you.

Our team of partners enhances our commitment to provide you with the right formula for your business needs.

We provide tax advisory services to small to medium-sized businesses (SMBs) and entrepreneurs in a wide range of industries, which but is not exclusive to:

General Independent Contractors (i.e., construction, manufacturing, real estate)

Transportation (Independent Owner-Operators and Form 1099 recipients, including transportation operators contracted by National transportation companies)

Mechanic and Auto Shops

Retailers, Restaurants, Bakeries

Gardeners, Beauty Salons

Transportation, including Driver Owner Operators contracted by National Transportation companies

Incorporation and Partnerships

Are you aware of the significant tax differences between the different entities available to you? Let us diagnose your business, identify your strengths and opportunities, and help you register your organization for the future.

Whether you are thinking of starting a business, already work as an independent contractor (Form 1099), own a small business and are ready for the next stage for growth – there’s a myriad of reasons to understand your state’s (e.g. California) complex incorporation and partnership laws.

Select the right structure to help ensure that you and your business receive all available tax benefits, deductions, and credits.

Vitae® Tax professional business advisors can help you understand the tax implications of available business entity structures so that you are better able to protect your money, your assets, and your interests. Do you have the proper business structure that will allow flexibility for growth and scalability? Let us help you answer the question.

Of course, we will assist you by preparing the necessary paperwork to register your legal entity. We’ll do more. We’ll help you shine a light on the pathway towards growth.

Tax Accounting and Tax Preparation

It isn’t surprising that while you focus your energies taking care of the operations of the business, tax planning is completely forgotten. As a result, certain tax requirements are overlooked. This can lead to small costly and unnecessary business tax planning mistakes.

The reality is that tax compliance is a bit like dentistry. Both suffer from an image problem. People often think about the pain without appreciating the benefits.

Vitae® Tax offers comprehensive tax preparation that includes tax bookkeeping and tax accounting services that are tailored to meet your business needs. We are actively weighing growth benefits for you and your business, by ensuring that no details are overlooked and that a tailored tax plan is in place to take advantage of all tax benefits permissible by law.

We build “Tax Books” to support every tax return

When you trust us with your tax accounting and tax preparation you will have the peace of mind that all tax forms are completed to file your business tax returns will be supported by “Tax Books”.

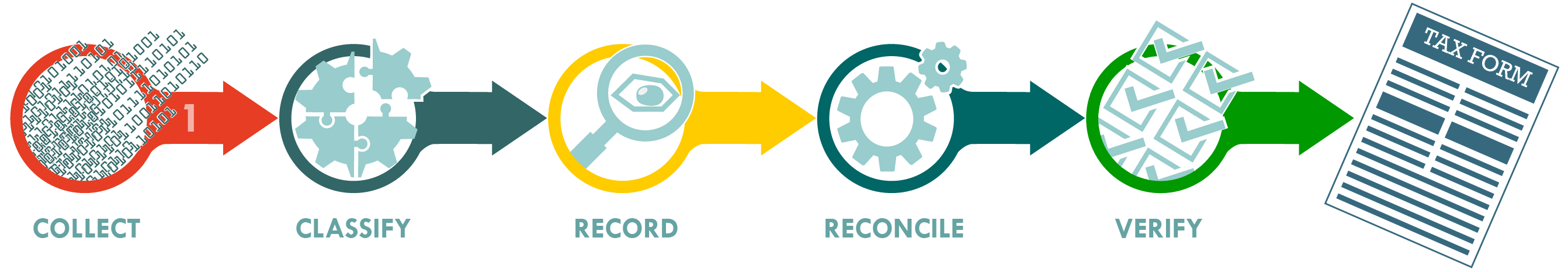

We Collect, Categorize, and Record every transaction reflected on bank and credit card statements, and then we Reconcile and Verify each record to assure reasonability and completeness. Your tax returns are supported with fully documented tax book.

Of course, you’ll ask, “why trust Vitae® Tax to file your business tax return?”

You can rest on our qualifications as tax professionals. You may also find it comforting that our tax professionals (CPAs, EAs) share decades of experience in public accounting and government tax auditing. But experience and expertise are only a part of what we offer. The best part is how we spend time with you discovering the nuances of your current business track. We not only get to know you and what you expect, but we also dig into the details of your business sector and how tax law can facilitate growth. Yes, we work to serve your expressed objectives, but we also bring tailored solutions to give you unexpected advantages:

It is vital to stay in full compliance with business tax and regulatory requirements. It’s our business intelligence that will make a difference when structuring a plan for you to achieve such compliance level.

We are a professional tax bookkeeping and tax accounting service offering in-person, face-to-face interaction with a fully trained real-life practitioner.

We ensure that every tax return is in full compliance with State and Federal tax law (Internal Revenue Code, section 446).

We offer total support in the event of a tax audit, you’ll never be alone to defend yourself.

Professional Representation for Tax Audits

Hopefully, you’ve never received an audit letter from the IRS or another governmental tax agency. If you have, then you know that this is one time when accounting comes front and center. Nothing is more important than having exact numbers, precise documentation, and specific answers for every tax audit question. It is very important that you consider professional representation to support you in any tax audit journey.

Busy schedules prevent you from focusing on recording every business transaction and resolving possible tax issues. We work to be proactive to avert tax audits, but on the basis that you cannot control when or who will be audited at any time. With Vitae® Tax professionals on your team, you’ll enter an tax audit with ease and confidence.

Understanding the tax audit process, our team of experienced CPAs and EAs take the lead in organizing your repsonses to every tax audit inquiry. We help you do more homeowrk so you can pass your test with flying colors.

As CPAs and EAs, your team is fully authorized to represent you before any government tax audits, including:

Personal income tax audits

Business tax audits

Federal and state payroll tax audits (e.g. California Employment Development Department EDD)

State sales tax audits (e.g. California CDTFA)

If and when an audit occurs, the Vitae® Tax team will help guide and support you all the way

Full-Service Payroll Processing

Outsource your payroll processing and you will save money, time, and avoid headaches.

Tired of filing Federal and State (e.g. California Employment Development Department —EDD) payroll tax forms?

When you bring in our Payroll Team “in-house,” we give you even greater flexibility and scope. You gain significant benefits of personal guidance in the latest changes in payroll tax rules. Our payroll team shuns“cookie-cutter” payroll methodologies and instead is focused on creating new efficiencies while reducing non-compliance risks.

When you trust us to process your payroll needs; you gain access to in house support, backed by some of the world’s largest payroll processors.

You gain timeliness, convenience, and flexibility when our payroll processing team works to generate fast, valid, and worry-free service. You can get back to running and growing your business knowing that we’re taking care of all your payroll needs.

We offer the following payroll services:

Electronic deposit employee payroll

Prepare and file federal and state quarterly and annual payroll tax returns

Prepare and file W2/W3 and 1099 forms

Manage online payroll services

And so much more

Vitae® Tax

We’re ready to serve you.

Call us for an one time personalized consultation.